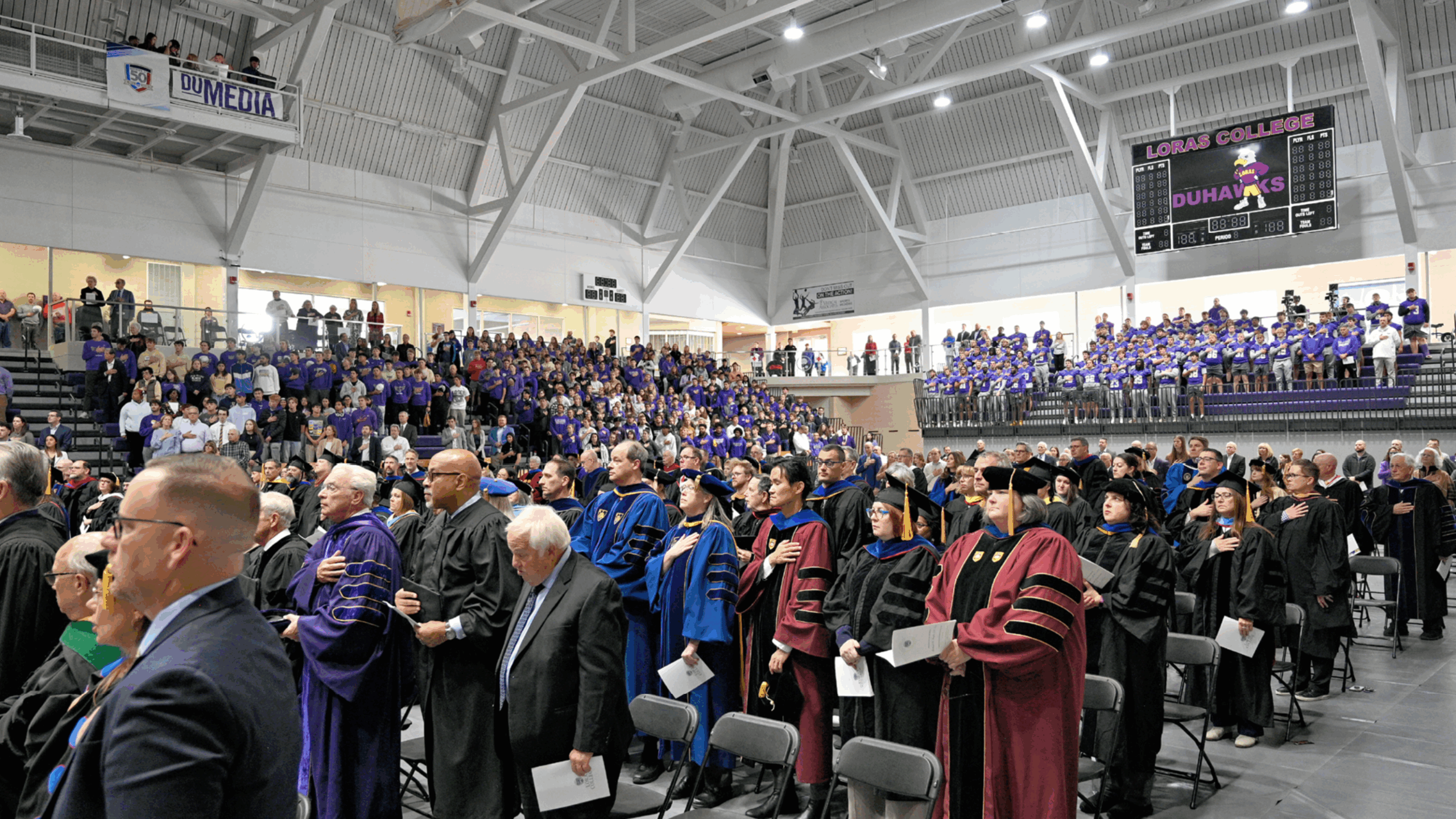

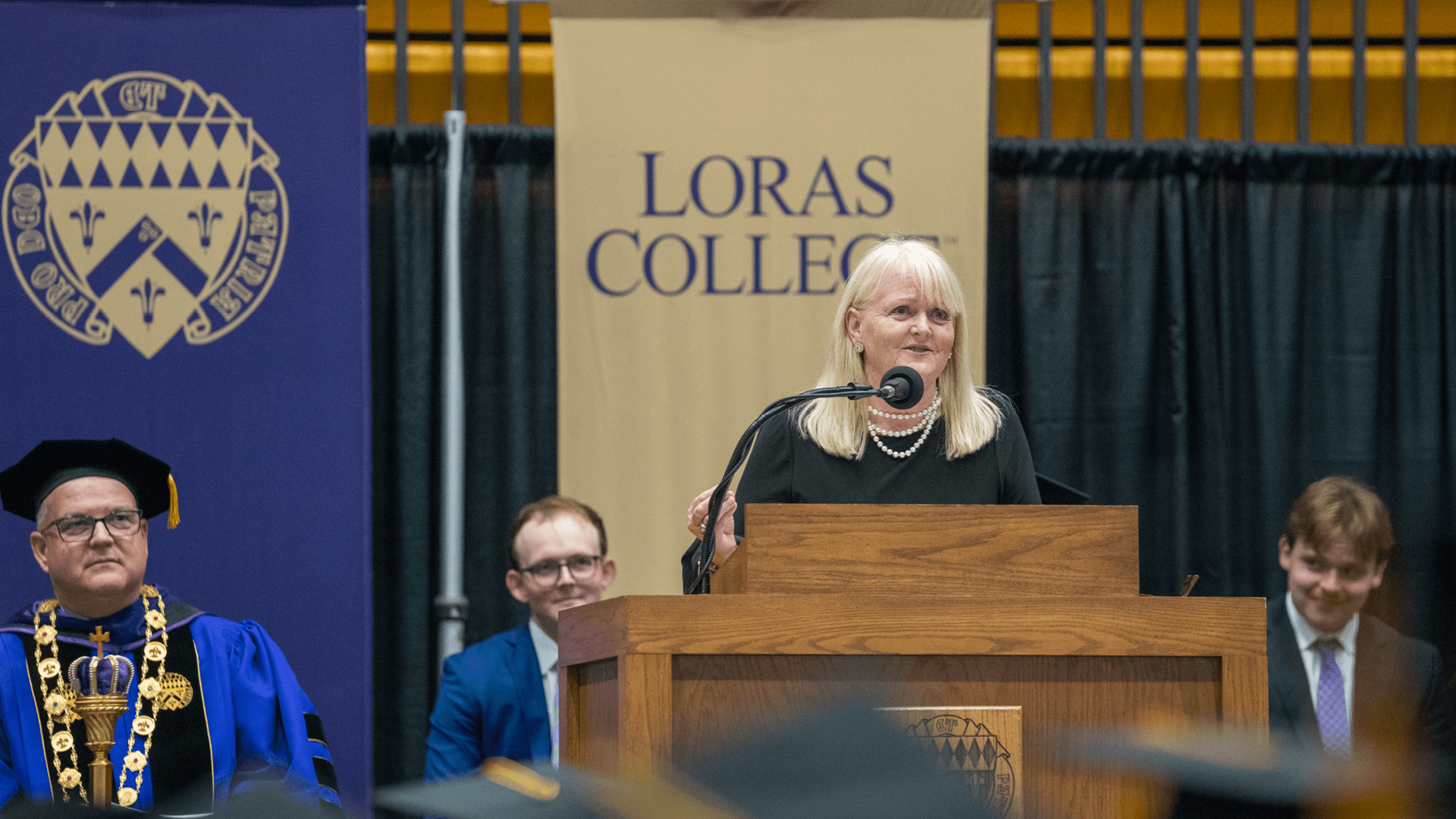

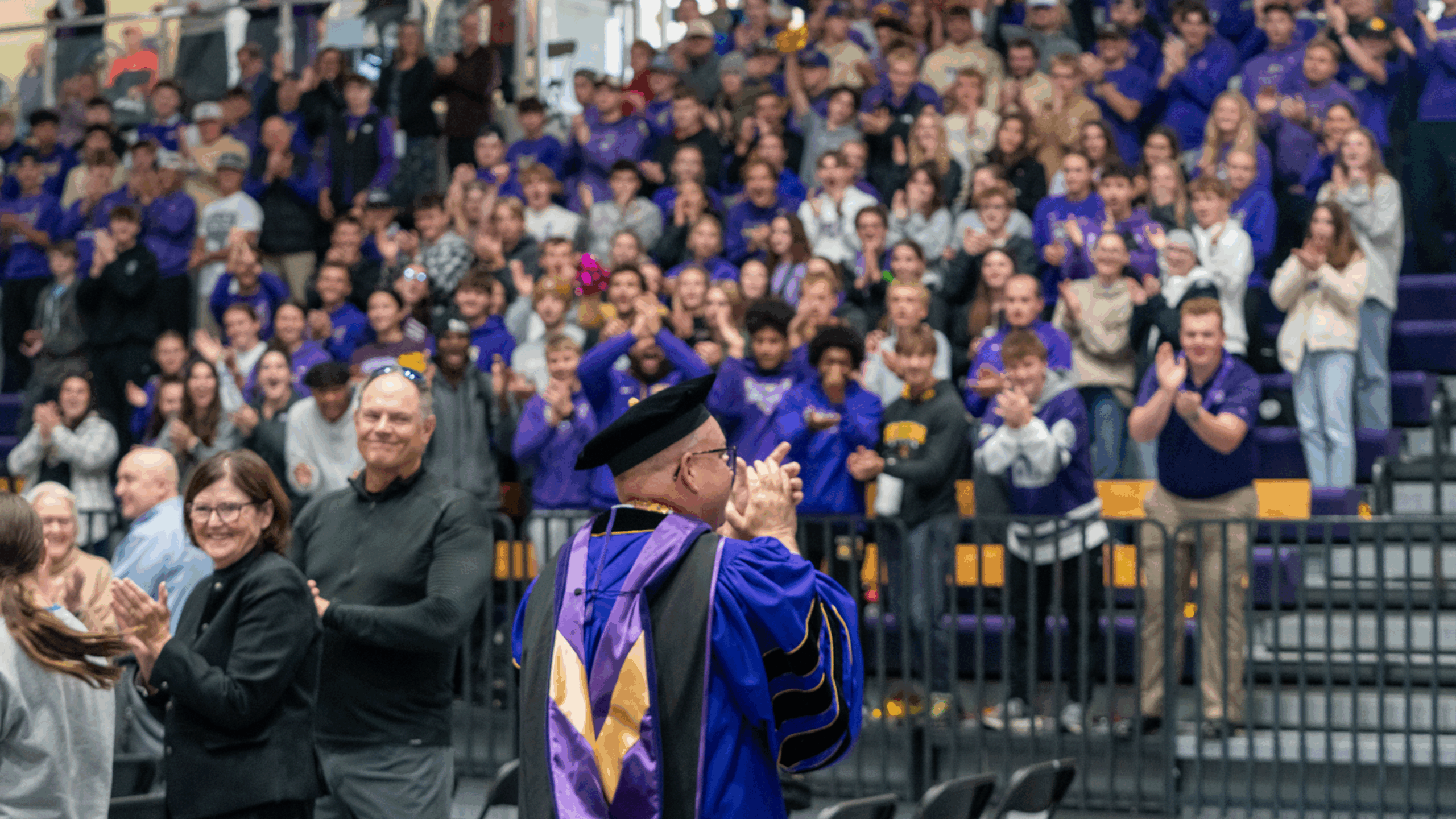

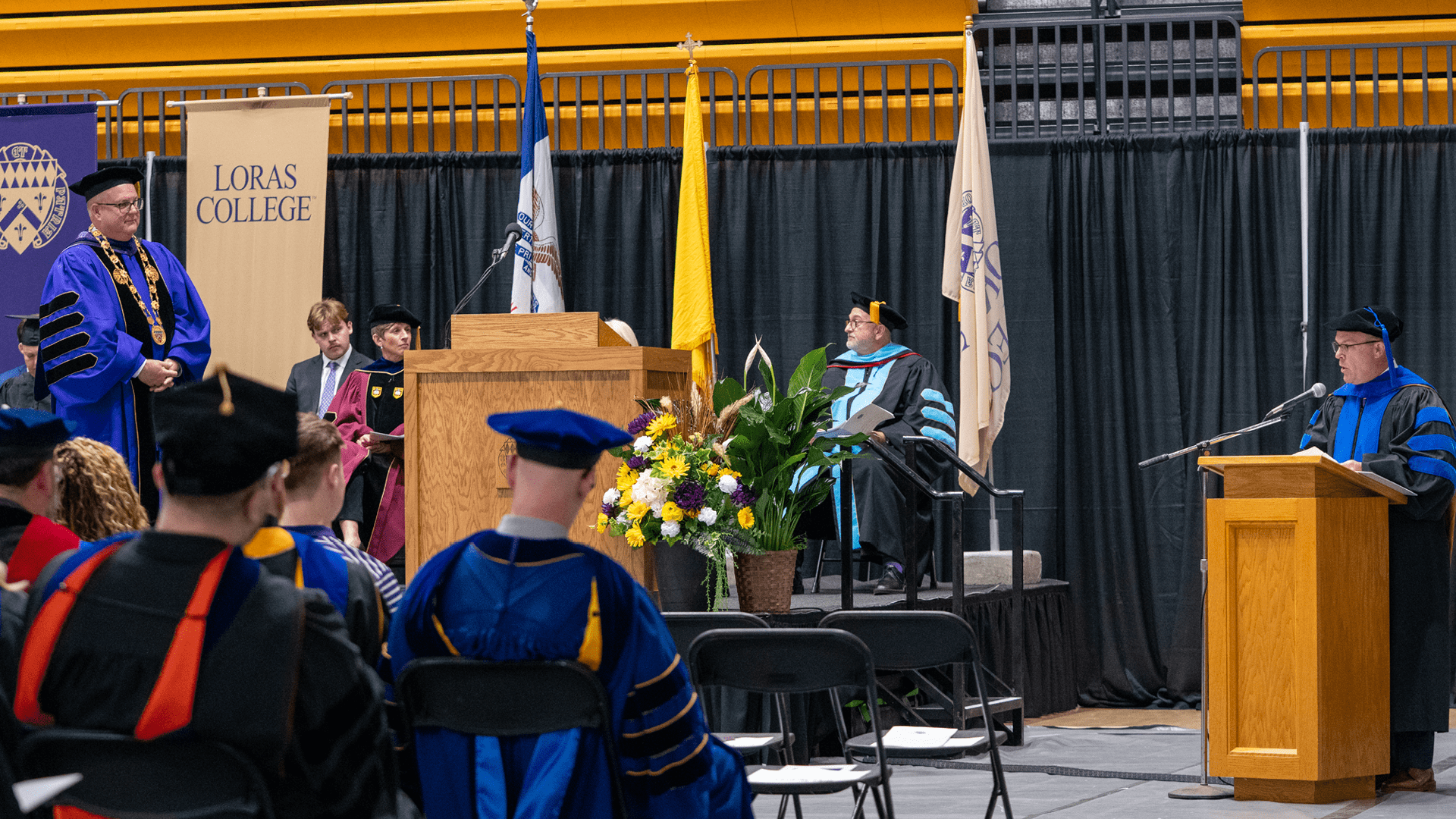

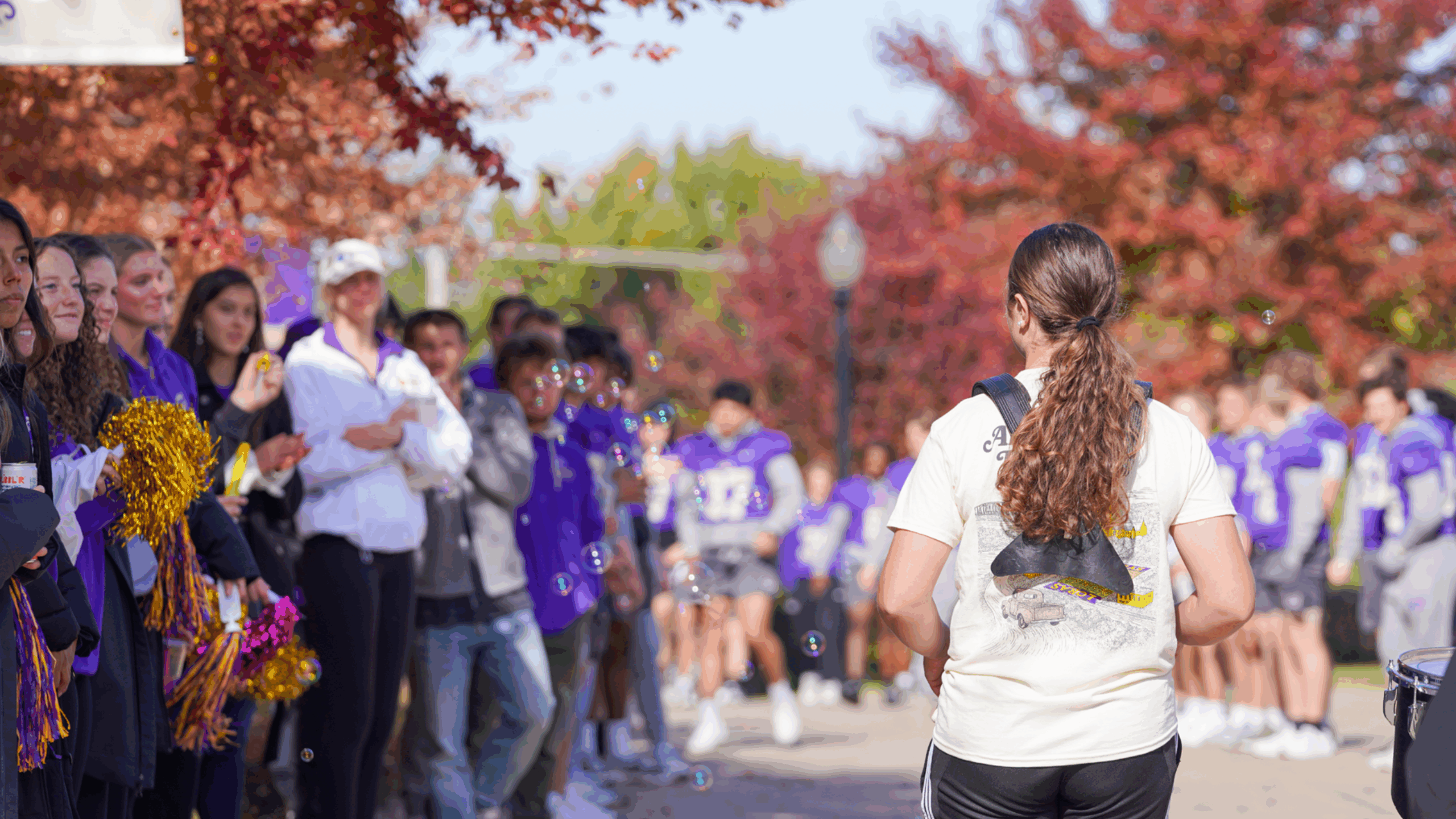

Enjoy some of our favorite memories from the day. Go Duhawks!

INAUGURATION VIDEOS & NEWS

MEET THE PRESIDENT

The Board of Regents of Loras College is pleased to announce the appointment of Michael (Mike) Doyle, J.D. (’91) as Loras College’s twenty-seventh President. A 1991 magna cum laude graduate of Loras College, Doyle brings a wealth of experience in higher education leadership, finance, and advancement to the role. Beginning in 2007, he served in multiple roles at Loras, most recently as vice president for advancement and treasurer (CFO) at Loras, where he was a principal member of the College’s leadership team until 2021.

During his tenure at Loras, Doyle led the College’s advancement efforts to unprecedented success. He spearheaded the “Inspiring Lives & Leadership” campaign, which surpassed its goal and marked the most extensive capital campaign in the College’s 185-year history. Most recently serving as president of Steele Capital Management from December 2021 to the present, Doyle’s career path reflects a blend of legal expertise, financial acumen, and strong leadership in higher education. After earning his Juris Doctor from Marquette University Law School in 1994, he passed the Certified Financial Planner exam in 2002. He worked as a financial advisor at prominent firms, including Northwestern Mutual Life, Richardson Financial Group, and Ernst & Young, LLP.

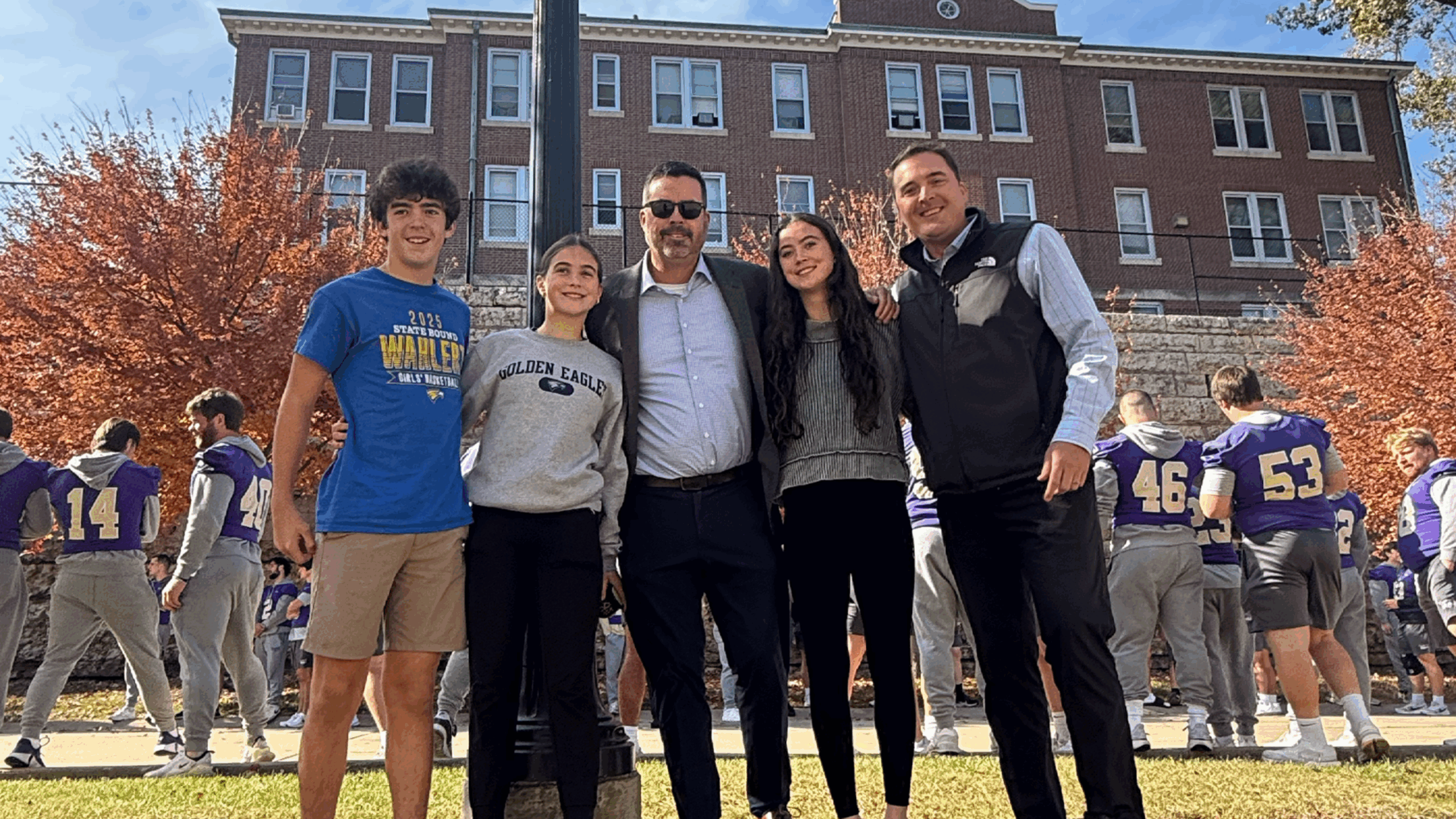

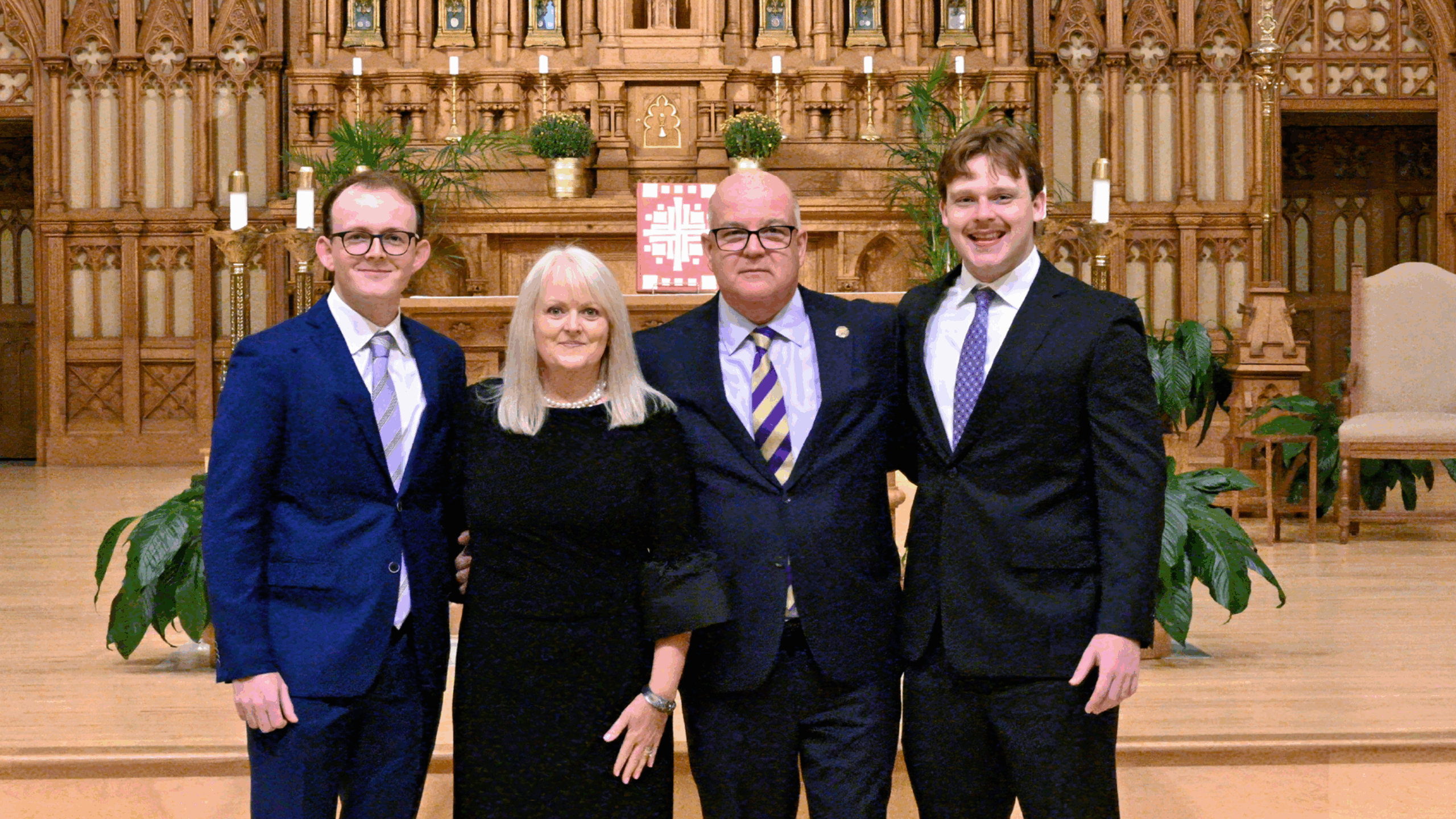

A native of Shullsburg, Wisconsin, Doyle has strong ties to the Dubuque area. He resides in Asbury, Iowa, with his wife Martha and their sons Jack and Hugh.